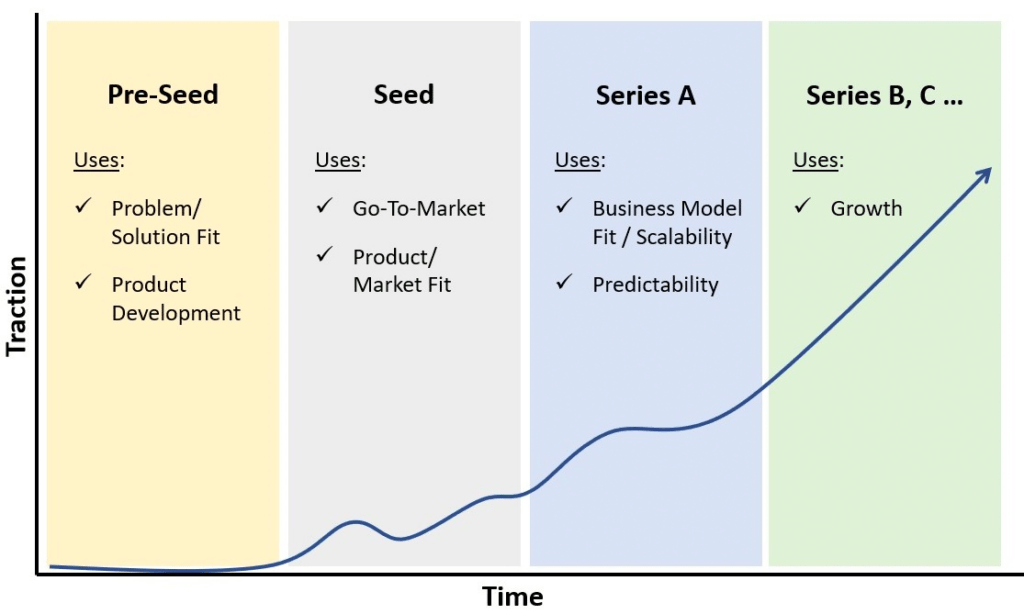

Seed, Series A, Series B, Series C, and so on are all levels of startup financing. Startups should be cautious about the fundraising rounds they will undergo, which are often dependent on the company's present maturity and progress. The following is an outline of the various startup phases.

Seed investment is the first step of funding for a business. Seed capital is often provided by angel investors, friends and family members, and the original firm founders. A firm in its early stages may seek finance via bank loans, although angel investments are frequently favored. Seed capital is used to launch the firm, hence it has a significant risk: the company has not yet proved itself in the market. Many angel investors specialize in seed financing possibilities because it enables them to acquire a portion of the company's stock while it is at its lowest value.

What are startup funding stages?

Series A investment is the next level of the startup fundraising process. This is the point at which the firm (which is generally still in its early stages) puts itself available to further investment. Series A fundraising is often significantly larger than angel investor funding, with capital of greater over $10 million typically being obtained. Series A capital is often obtained to assist a startup's debut. The company will announce its availability to Series A investors and will be required to give an adequate value. Finally, there is financing for Series B, C, D, and beyond. Companies that have previously achieved success and are looking to extend that success seek later stage finance.

Regardless of the stage of the firm, each round of the startup finance process runs relatively identically. During the startup fundraising process, the firm must be able to demonstrate its value and must have clear plans for how it intends to utilize the funds obtained. Each round of fundraising will inevitably erode the company's equity.

Pre-Seed Capital

Pre-seed finance has arisen as a new fundraising step in recent years.A pre-seed round is a venture capital round that is often the first round of institutional money raised by a business. In general, a pre-seed financing helps a founding team to identify product-market fit, acquire early workers, and test go-to-market models.

As a general rule, money should be available for 12 to 18 months. It should be sufficient funds to enable you to easily meet your objectives and the projection you established throughout the pitching and fundraising phase.

The average amount of pre-seed money

The size of pre-seed rounds varies greatly across companies. There is no hard and fast rule. According to research, pre-seed round sizes might vary from $100,000 to $5 million. Finally, while establishing valuations and how much to raise, you should consider your company's requirements.

How can you get pre-seed funding?

A pre-seed round is similar to a standard B2B sales procedure. You'll be talking to and adding investors at the top of your funnel, pitching and negotiating in the middle, and ideally closing them at the bottom. Learn more about developing a fundraising process in our guide, "All-Encompassing Startup Fundraising Guide."

We met with Jonathan Gandolf, CEO of The Juice, every week throughout his pre-seed fundraising to discuss what he was learning. We condensed the discussions into eight episodes. Listen to it below:

Who funds pre-seed rounds?

One advantage of a pre-seed round is that it allows for more sorts of investors since the check amounts are often smaller:

Angel investors are a popular starting point for a pre-seed round. Angel investors are people who can issue cheques ranging from a few thousand dollars to $500,000 or more.

Accelerators/Incubators – Many accelerator programs may run concurrently with a pre-seed round or may issue follow-on checks after finishing their program to assist in funding your pre-seed round.

Dedicated Venture Capital Funds — Many specialized pre-seed funds have emerged in recent years and have become a fixture in the market. Traditional and bigger businesses are also participating in pre-seed rounds.