What Is a Business Exit Strategy?

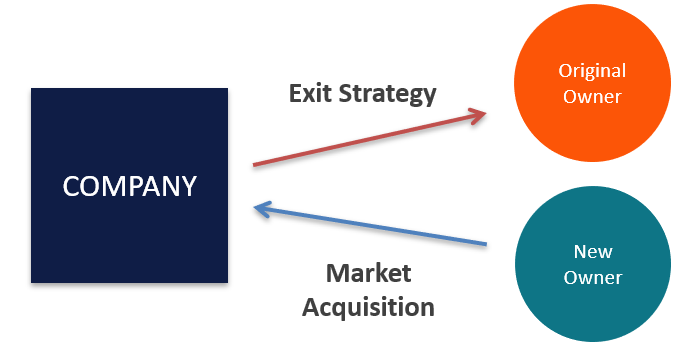

The strategic plan that an entrepreneur has in place to sell his or her ownership stake in a firm to investors or to another company is referred to as an exit strategy for the business. A business owner has the ability to decrease or liquidate his ownership in a company via the use of an exit plan, which results in a considerable profit for the owner in the event that the company is successful. When an entrepreneur has an exit strategy (also known as a "exit plan"), they are able to reduce their losses in the event that the firm is not successful. When it comes to planning for a cash-out of an investment, an investor, such as a venture capitalist, may also adopt an exit strategy in order to maximize their potential returns.

It is important to differentiate between trading exit strategies and business exit plans, since the latter are used in the securities markets.

Understanding Business Exit Strategy

In a perfect world, an entrepreneur would first create an exit strategy as part of their first business plan before actually beginning their company venture. It is possible for the selection of which exit strategy to choose to impact corporate growth choices. Initial public offerings (IPOs), strategic acquisitions, and management buyouts (MBOs) are all examples of common forms of exit plans. The choice of exit strategy that an entrepreneur makes is contingent upon a multitude of factors, including the degree of control or involvement (if any) that they wish to maintain in the business, whether they wish for the company to continue to be managed in the same manner after their departure, or whether they are willing to oversee a change in the company's direction, provided that they are compensated adequately to leave.

A strategic purchase, for instance, may release the founder from the duties associated with ownership of the company; nevertheless, this will also imply that the founder will abandon management of the company. Because initial public offerings (IPOs) often carry with them the largest payout and the most reputation, they are frequently regarded as the holy grail of exit options. When it comes to exiting a corporation, however, filing for bankruptcy is considered to be the least desired option.

Business valuation is an essential component of an exit plan, and there are professionals that can assist business owners (and purchasers) in analyzing the financials of a company in order to arrive at an accurate calculation of the firm's worth. In addition, there are transition managers whose job it is to provide sellers with assistance in developing exit plans for their businesses.

Business Exit Strategy and Liquidity

Different business exit strategies also offer business owners different levels of liquidity. Selling ownership through a strategic acquisition, for example, can offer the greatest amount of liquidity in the shortest time frame, depending on how the acquisition is structured. The appeal of a given exit strategy will depend on market conditions, as well; for example, an IPO may not be the best exit strategy during a recession, and a management buyout may not be attractive to a buyer when interest rates are high.

Business Exit Strategy: Which Is Best?

The sort of firm and its scale are additional factors that determine the most appropriate exit plan. The optimum exit plan for a lone owner can simply consist of making as much money as possible and then closing down the firm. On the other hand, a partner in a medical office might gain by selling to one of the other partners who are already members of the partnership. If the firm was founded by more than one person, or if there are major shareholders in addition to the founders, then the interests of these other parties must also be taken into consideration when selecting an exit plan for the company.